What Are Off Plan Properties

Off plan properties are homes or commercial units sold before construction completes. Buyers commit based on floor plans, unit mix, and a developer’s track record. Payment is staged through a schedule that typically runs from booking to handover, and sometimes into a post-handover period.

Why Investors Consider Off Plan Properties

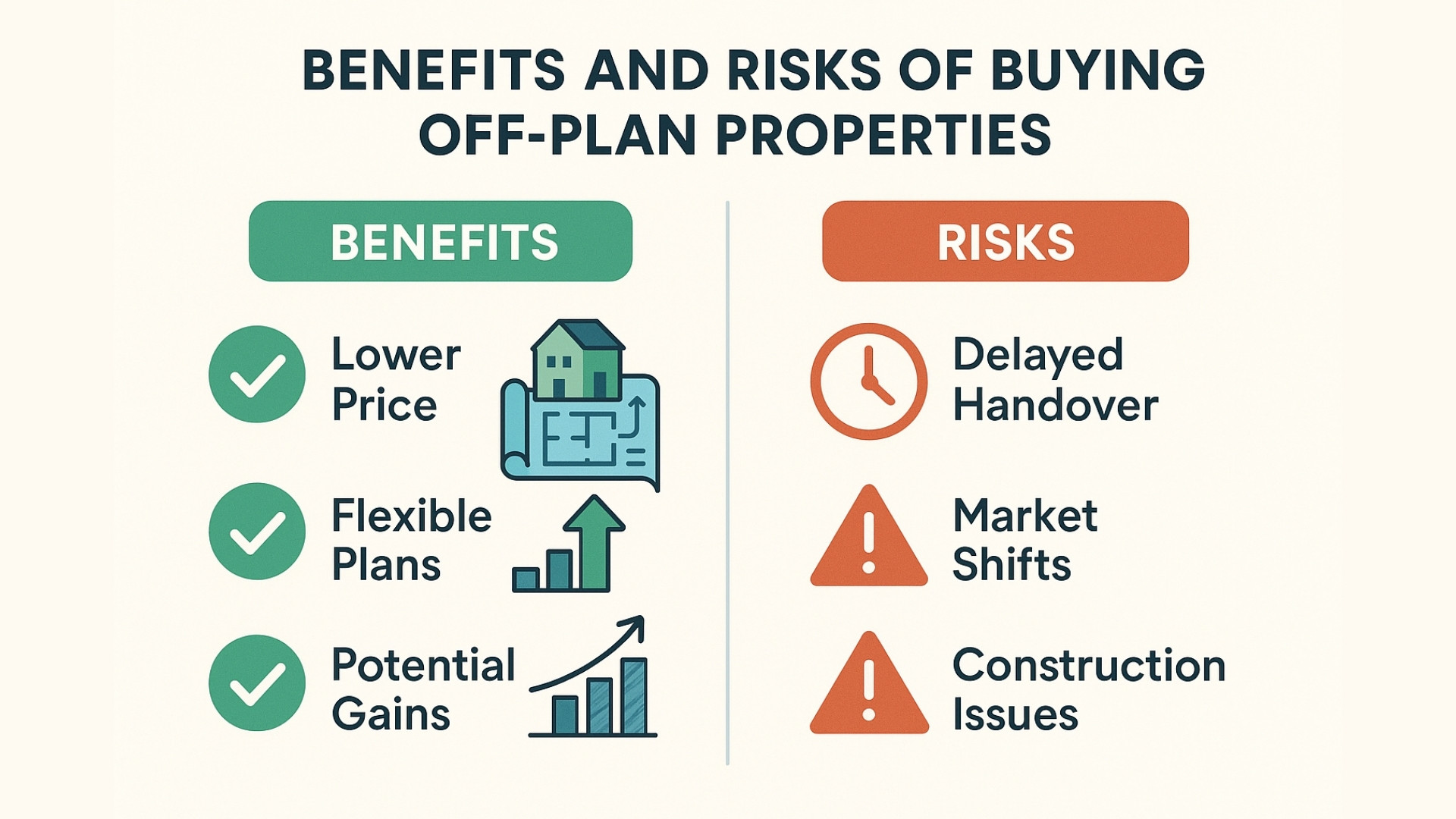

Off plan properties can unlock pricing advantages, flexible payment plans, and customization opportunities. With the right developer and location, investors may capture capital appreciation between purchase and completion. Strong projects also draw robust tenant demand at handover, which supports yield.

Key Benefits of Buying Off Plan

1) Lower Entry Price and Flexible Payments

-

Early pricing can be below ready-property levels in similar areas

-

Structured plans reduce cash strain during construction

-

Post-handover plans, where available, align payments with rental income

-

Developer incentives can include fee waivers or limited-time discounts

2) Capital Appreciation During Construction

-

Prices in quality projects often step up at each construction milestone

-

New infrastructure and community facilities add area value

-

Supply remains limited in prime addresses, which supports pricing

3) Customization and Choice

-

Early buyers select floors, orientations, and preferred layouts

-

Finishing options may be available in selected projects

-

Parking allocations and storage choices can be secured sooner

4) New-Build Warranty and Lower Immediate Maintenance

-

Manufacturer and building warranties cover key components

-

Efficient systems reduce initial operating costs

-

Handover snagging resolves defects before move-in

The Risks You Must Measure

1) Timeline and Delivery Risk

Construction can face delays from approvals, materials, or weather. Completion dates are forecasts, not guarantees.

Mitigation: focus on developers with audited escrow accounts and a record of on-time deliveries. Track progress updates and check approvals.

2) Market Volatility

Prices can fluctuate during the build period. Mortgage rates and macro trends affect affordability.

Mitigation: buy in supply-constrained locations with strong fundamentals. Maintain finance buffers.

3) Developer and Contractor Risk

Corporate or project-level issues can hit timelines and quality.

Mitigation: review the developer’s delivered communities, financial strength, and contractor history. Verify escrow arrangements.

4) Quality and Specification Gaps

Final finishes may differ from brochures or show units.

Mitigation: read specifications in the SPA carefully and plan for snagging with a professional checklist at handover.

5) Resale and Assignment Restrictions

Some SPAs restrict assignment before reaching a payment threshold.

Mitigation: confirm assignment policy, fees, and eligibility before you buy.

Understanding the Legal and Financial Framework

Escrow Accounts and Buyer Protections

Funds for off plan projects are typically held in a regulated escrow account. Developers draw from escrow as construction progresses and milestones are certified. This structure helps protect buyers by tying cash release to achieved progress.

Project Registration

Projects are registered with the relevant authorities and must meet disclosure and approval requirements before sales. Always confirm that the project is registered, the developer is approved, and that marketing materials match approvals.

Sales and Purchase Agreement (SPA)

The SPA sets the binding terms. Key items to check:

-

Final layout, area statement, and tolerances

-

Payment schedule, penalties, and grace periods

-

Handover standards and snagging process

-

Service charges estimate and what they include

-

Resale, assignment, and post-handover rules

-

Default, termination, and refund clauses

Fees and Ongoing Costs

Expect a registration fee at the time of purchase, admin charges, and later service charges once the building operates. Factor in mortgage costs if you finance. Ask for a full fee schedule before committing.

How a Typical Payment Plan Works

Common Structures

-

Booking fee: a small initial amount to reserve the unit

-

During construction: staged installments at fixed milestones

-

On handover: a larger final installment on completion

-

Post-handover (if offered): additional installments after move-in

Example only: 10 percent booking, 50 percent during construction, 40 percent on handover. Terms vary by project and developer. Always confirm the official schedule.

Step-by-Step: Buying Off Plan Properties

Step 1: Define Strategy and Budget

Clarify target yield, holding period, and exit plan. Secure mortgage pre-approval if financing.

Step 2: Shortlist Developers and Locations

Screen past deliveries and community performance. Prioritize areas with transport access, schools, retail, and employment hubs.

Step 3: Compare Payment Plans and Total Cost

Evaluate booking amount, stage payments, handover amount, fees, and service charges. Model cash flow through handover and first year of leasing.

Step 4: Due Diligence on the Project

Check approvals, escrow status, construction contractor, and delivery record. Read the SPA and specifications in detail.

Step 5: Reserve the Unit and Open Files

Complete booking, submit KYC, arrange registration, and coordinate with the developer and your conveyancing advisor.

Step 6: Monitor Construction and Variations

Track milestone notices and site updates. Approve variations only if they improve value. Keep every receipt and notice.

Step 7: Handover Preparation

Schedule a snagging inspection, collect completion documents, set up utility connections, and plan leasing or move-in.

Step 8: Leasing and Stabilization

Launch marketing, screen tenants, sign the tenancy, and arrange move-in. Monitor service charges, maintenance, and rent collection.

Who Should Consider Off Plan Properties

-

Investors with a 3 to 7 year horizon

-

Buyers who value staged payments over a single large outlay

-

Owners seeking modern layouts and efficient buildings

-

Early movers willing to secure the best stacks and views

Who May Prefer Ready Properties

-

Buyers who need immediate occupancy or income

-

Investors with low tolerance for timeline shifts

-

Anyone unable to commit to stage payments

-

Owners who want to physically inspect before purchase

Risk Mitigation Checklist

Developer and Project

-

Verify project registration and escrow

-

Review last 3 to 5 years of delivered projects

-

Confirm contractor reputation and construction insurance

Contracts and Payments

-

Cross-check SPA clauses, penalties, and grace periods

-

Understand assignment rules and any transfer fees

-

Keep a reserve for service charges and variations

Quality and Handover

-

Hire a professional snagging team

-

Obtain appliance warranties and building manuals

-

Log defects and track rectification timelines

Leasing and Yield

-

Pre-list 8 to 10 weeks before handover

-

Benchmark rents using market data

-

Consider furnished leasing if unit type and area support a premium

Emotional Journey and Expectation Setting

Buying off plan is exciting, but it also requires patience. You commit to a plan, then you watch a site become a building over months. Clear timelines, regular updates, and a reliable manager keep stress under control. Treat the project like a business with scheduled check-ins and written records.

FAQs About Off Plan Properties

Is financing available before completion?

Yes, subject to lender criteria and project approvals. Pre-approval helps you secure a realistic budget.

Can I resell before handover?

Some SPAs allow assignment after reaching a payment threshold. Policies vary. Confirm eligibility and fees before buying.

What happens if the project is delayed?

Read delay clauses in the SPA. These define notices, remedies, and rights. Work only with registered projects and reputable developers.

How do I compare two payment plans?

Model total cash out by month, include fees, and add a handover leasing forecast. Pick the plan that protects liquidity without eroding yield.

What documents should I keep?

Booking forms, receipts, SPA, variations, escrow letters, progress notices, handover certificates, warranties, and your snagging report.

Conclusion and Next Steps

Off plan properties can deliver strong outcomes when due diligence, cash flow planning, and quality control are in place. The best results come from buying with a credible developer in a high-demand location, locking a sensible payment plan, and preparing early for leasing.

For investors seeking safe off plan property in Dubai, developer choice is key.