Why “Best Off‑Plan Investment in Dubai” Is About Strategy (Not One Project)

The smartest 2025 plays aren’t a single “hot” launch—they’re repeatable strategies that align with how Dubai’s market creates value: brand premiums, scarcity on the water, master‑planned growth, and end‑user family demand. Your job is to match a strategy to your risk tolerance, time horizon, and cash‑flow plan.

2025 Snapshot: What’s Driving Returns Right Now

Dubai’s off‑plan market remains the engine of sales in 2025, underpinned by stronger regulation (RERA, escrow, sales permits), deeper global demand (Golden Visa thresholds), and a pipeline from blue‑chip developers. The winning moves: buy branded where the premium is defensible, buy waterfront where scarcity is real, enter early in master communities with clear infrastructure, and serve family housing needs with villas and townhouses.

The Four Best Off‑Plan Investment Strategies in Dubai (2025)

1) Branded Residences: Luxury With Defensible Premiums

Why it works: Brand assurance (design, service, finishes) attracts HNW tenants and buyers, supporting higher achieved rents and exit values.

Who it’s for: Long‑term, quality‑led investors comfortable with higher entry pricing.

2025 spotlights to research: Cavalli Tower (Dubai Marina, DAMAC), Safa One by de GRISOGONO (Al Wasl, DAMAC), Como Residences (Palm Jumeirah, Nakheel), Address/Armani/One&Only concepts by Emaar in prime locations.

Key risks/costs: Price premium vs non‑branded stock; higher service charges; brand‑management clauses in SPAs and building regulations.

Explore our full guide to branded residences in Dubai.

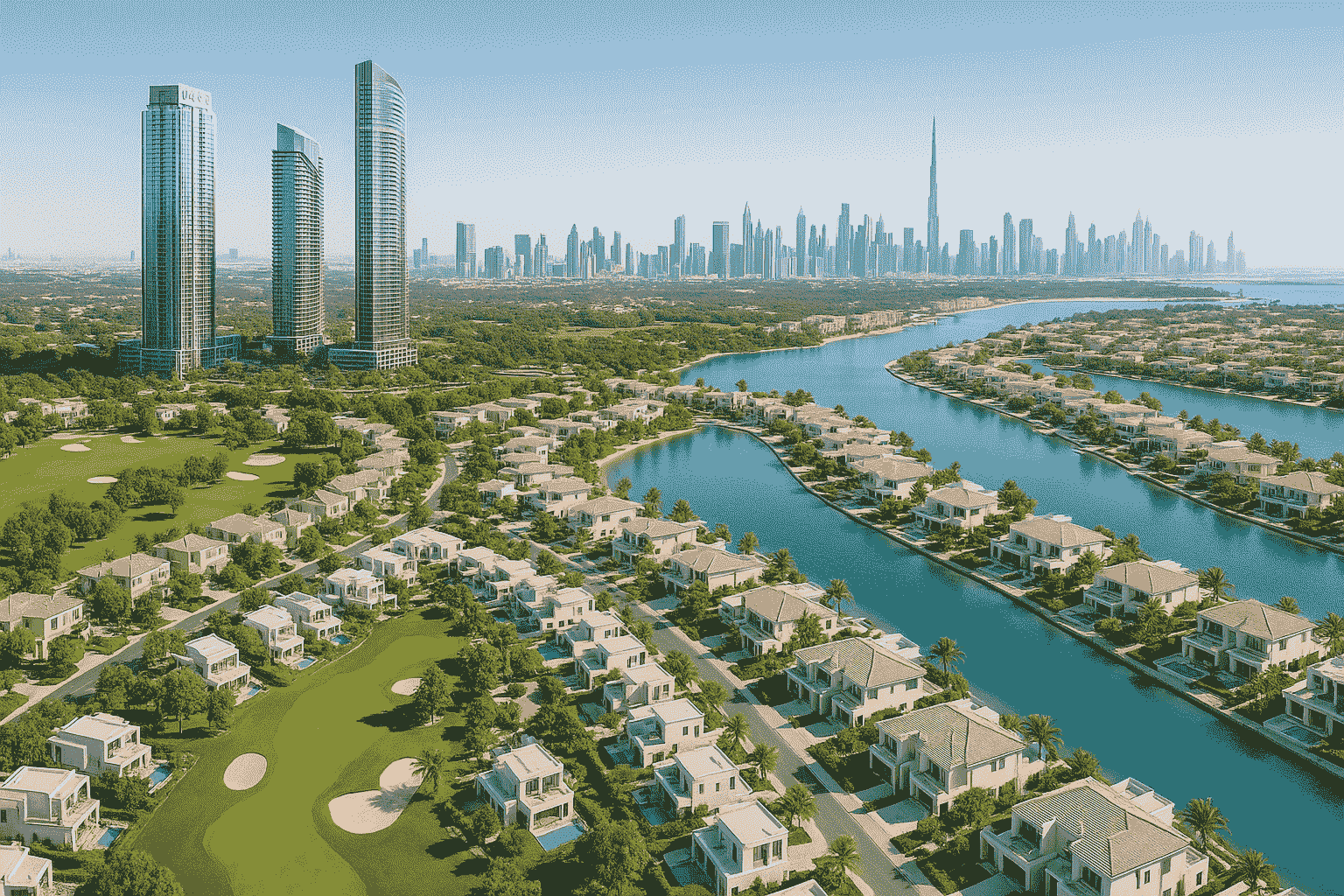

2) Waterfront Properties: Scarcity That Compounds

Why it works: Finite coastline + global demand keeps absorption strong through cycles; waterfront rentals command a consistent premium.

Who it’s for: Capital preservation + trophy‑asset buyers seeking durable demand.

2025 spotlights to research: Palm Jebel Ali signature villas/townhouses (Nakheel), Dubai Islands Bay Villas (Nakheel), projects at Emaar Beachfront, Sobha Seahaven (Dubai Harbour, Sobha), projects in Dubai Maritime City and along Dubai Canal.

Key risks/costs: Higher service charges vs inland; marine environment maintenance; insurance variations—budget for these in yield models.

Read our complete overview on waterfront property in Dubai.

3) Emerging, Community‑Focused Hotspots: First‑Mover Upside

Why it works: Buying early in proven master plans often captures appreciation as schools, parks, retail and mobility arrive.

Who it’s for: 3–7 year, growth‑focused investors.

2025 spotlights to research: New releases in Dubai Hills Estate, cluster launches in DAMAC Lagoons & DAMAC Islands, high-yield projects in Jumeirah Village Circle (JVC), infrastructure-adjacent developments in Emaar South, and new phases in Tilal Al Ghaf by Majid Al Futtaim.

Signals to watch: Developer pedigree, phase roadmap, civic infrastructure (education, healthcare), access (metro/highways), unique proposition (golf, lagoons, beach).

Discover more in our hub for emerging communities in Dubai.

4) Villas & Townhouses: Serving End‑User Family Demand

Why it works: Post‑pandemic preference for space, private outdoors, parking, schools and sport facilities—villas and townhouses see sticky occupancy and resilient resale.

Who it’s for: Investors targeting stable tenancies and longer holds; end‑users planning a move‑in on completion.

2025 spotlights to research: Arabian Ranches releases (Emaar), Golf Lane & Emaar South villas (Emaar), DAMAC Hills/2 collections (DAMAC), Alaya/Amara at Tilal Al Ghaf + Ghaf Woods (Majid Al Futtaim), Jebel Ali Village (Nakheel).

Key risks/costs: Service charges differ widely; plot/plan changes during development; landscaping and façade upkeep at handover.

Browse dedicated hubs for off-plan villas and townhouses.

Developers Leading Each Strategy (Quick Picks)

-

Emaar Properties: Integrated masterplans, blue‑chip delivery; think Downtown, Dubai Hills Estate, Emaar Beachfront, Creek Harbour.

-

Nakheel: Waterfront master developer; Palm Jumeirah, Palm Jebel Ali, Dubai Islands.

-

DAMAC Properties: Branded + themed communities; DAMAC Lagoons, DAMAC Hills, Safa One, Cavalli.

-

Sobha Realty: Backward‑integrated quality; Sobha Hartland I/II, Seahaven.

Payment Plans & Financing: Make the Numbers Work

Common structures include 60/40, 70/30, 80/20, and 50/50, with many new launches offering attractive post‑handover tranches. It's crucial to match the plan to your cash flow, not the other way round.

For the mortgage route, secure pre‑approval early, confirm your bank can disburse payments to the project's escrow account, and clarify the Loan-to-Value (LTV) ratio for residents versus non‑residents.

Due Diligence Checklist (Save This)

-

RERA & DLD: Verify the RERA project number and sales permit on the official Dubai REST app.

-

Escrow Account: Ensure all developer funds are paid exclusively to a registered escrow account.

-

SPA Terms: Meticulously review milestones, penalties, brand/amenity covenants, and Oqood/DLD fees in the Sales and Purchase Agreement.

-

Service Charges: Check service charge estimates and community rules (HOA/Mollak).

-

Handover Plan: Understand the process for snagging, utility connections, and the designated service provider.

For more, see our complete RERA & escrow guide and the main buyer’s ultimate guide pillar.

A Quick, Practical Shortlist: Best Off‑Plan Investment Ideas (2025)

-

Branded High-Rise: A unit with skyline or water views in a prime urban zone (e.g., Dubai Marina/Al Wasl) offers a defensible premium and attracts global demand.

-

Waterfront Apartment: An apartment in a limited‑supply district (Emaar Beachfront/Dubai Harbour) will command premium rents and resilient exit values.

-

Early-Phase Townhouse: A home in a maturing master community (DAMAC Lagoons/Emaar South) provides a strong opportunity for first‑mover appreciation.

-

Golf-Course or Park-Front Villa: A villa in a family hub (Dubai Hills Estate/Arabian Ranches) ensures sticky occupancy and a deep end‑user pool.

-

Signature Trophy Villa: A signature villa or plot in a UHNWI-focused waterfront community (Palm Jebel Ali/Jumeira Bay) offers unparalleled scarcity and status.

Risks That Matter (And How to Balance Them)

-

Pricing & Premiums: Branded/waterfront properties can have a significantly higher price per square foot. Balance this against proven rental demand and exit depth in the area.

-

Carrying Costs: Waterfront and branded residences often have higher service charges. Model your net yield with realistic expectations for insurance, maintenance, and sinking funds.

-

Delivery & Specification: Always review the developer’s delivery track record. Protect your investment with clear SPA specifications and a thorough snagging inspection.

-

Liquidity Timing: If your investment horizon is short (under 2 years), avoid projects with long build cycles. Favor assets in late‑stage construction or nearing handover.

How to Choose the Best Off‑Plan Investment in Dubai (Framework)

-

Define Goal: Are you seeking income, growth, or a blend of both?

-

Pick Strategy: Choose the strategy that matches your goal (branded, waterfront, emerging, family).

-

Shortlist Developers: Identify 2–3 developers with proven delivery in that strategy.

-

Compare Projects: Compare 3 comparable projects based on net yield (after service charges) and realistic resale comps.

-

Lock Financing: Secure a payment plan that fits your cash flow and pre‑approve any required financing.

-

Verify & Review: Verify all approvals, escrow details, and SPA terms. Book your snagging inspection early.

Next Steps

Start with our Ultimate 2025 Guide to Buying Off‑Plan Property in Dubai. If you want a curated shortlist matched to your budget, timeline and risk tolerance, contact our advisory team.