Choosing the right developer is arguably the most critical decision when investing in Dubai's off-plan property market. With billions of dirhams in sales and decades of experience, Emaar Properties, DAMAC Properties, and Nakheel have established themselves as the titans of Dubai real estate.

But which developer offers the best investment opportunity for your specific needs and budget? This comprehensive comparison analyzes market performance data, project quality, delivery track records, and investment potential to help you make an informed decision.

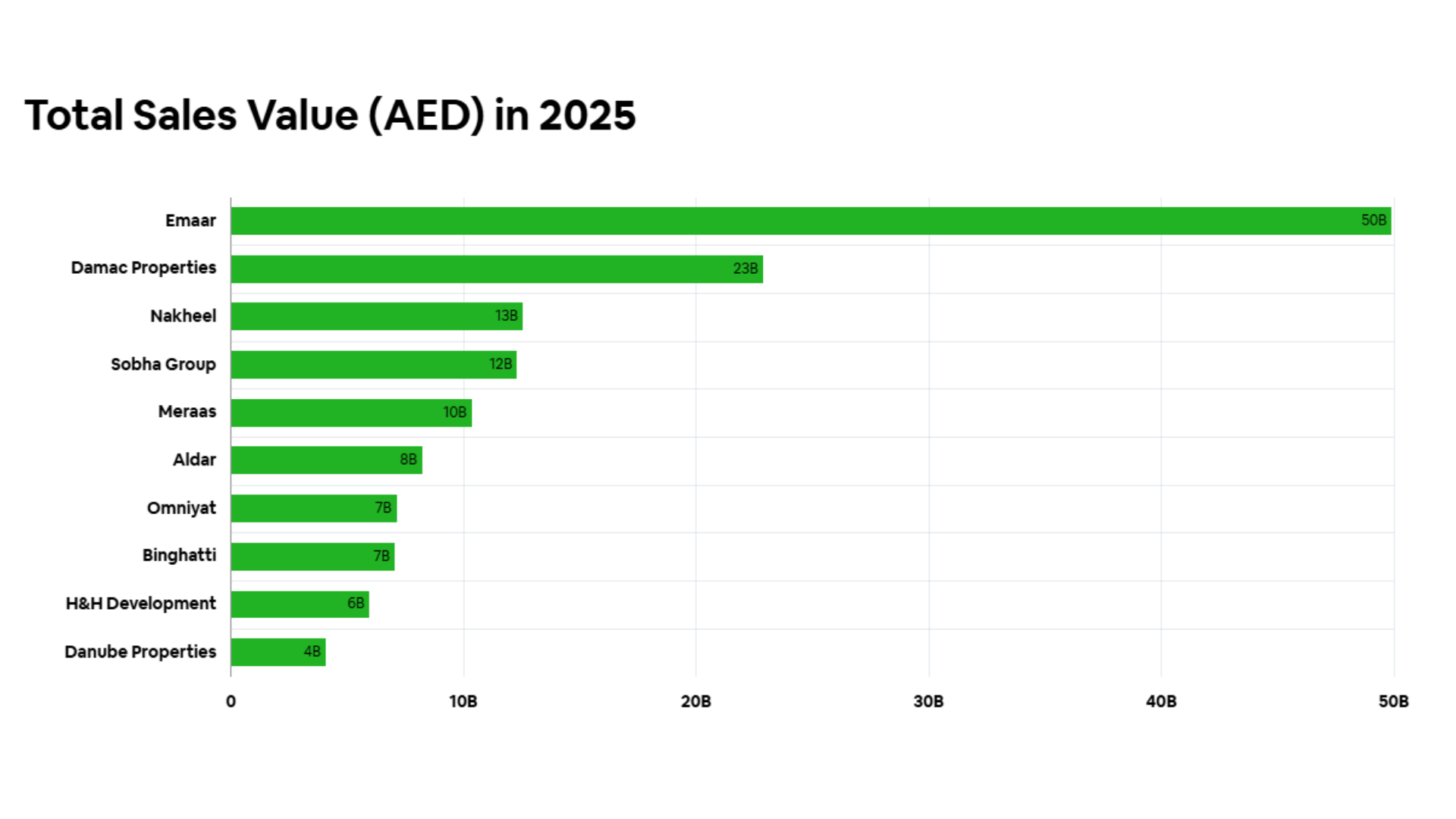

Market Performance: The Numbers Don't Lie

According to 2025 market data from Dubai's property transaction records, the sales performance hierarchy is clear:

2025 Total Sales Value (AED):

- Emaar Properties: 50 billion AED (Market Leader)

- DAMAC Properties: 23 billion AED (Strong #2)

- Nakheel: 13 billion AED (Waterfront Specialist)

- Sobha Group: 12 billion AED (Premium Quality Player)

Emaar's dominance with 50 billion AED in sales value—double that of DAMAC—reflects investor confidence built over decades of consistent delivery and iconic developments. This isn't just about size; it's about proven market trust and reliability.

Developer Deep Dive: Understanding Each Brand

Emaar Properties: The Blue-Chip Investment

Founded: 1997

Market Position: Market leader and most trusted brand

Signature Style: Integrated master communities with world-class amenities

Why Investors Choose Emaar:

Proven Track Record: As the developer behind Burj Khalifa, Dubai Mall, and Downtown Dubai, Emaar has delivered some of the world's most iconic projects. Their 27-year history includes zero major project cancellations and consistent on-time delivery.

Master Community Expertise: Emaar doesn't just build buildings—they create entire ecosystems. Dubai Hills Estate, for example, spans 11 million square feet with integrated schools, healthcare, retail, and recreational facilities.

Strong Resale Value: Emaar properties consistently show superior resale values. Data from Dubai Land Department shows Emaar properties in Downtown Dubai have appreciated 8-12% annually over the past five years.

Financial Stability: As Dubai's largest publicly listed developer (DFM: EMAAR), investors benefit from transparent financials and strong balance sheet backing.

Key Communities:

- Downtown Dubai (Burj Khalifa, Dubai Mall)

- Dubai Hills Estate (Family-focused master community)

- Emaar Beachfront (Exclusive waterfront living)

- Dubai Creek Harbour (Future city center)

- Arabian Ranches (Established villa community)

Target Investor: Conservative investors seeking blue-chip stability, families wanting integrated communities, and buyers prioritizing strong resale potential.

DAMAC Properties: The Luxury Innovator

Founded: 2002

Market Position: Luxury specialist with strong international appeal

Signature Style: Branded residences and themed lifestyle concepts

Why Investors Choose DAMAC:

Luxury Brand Partnerships: DAMAC pioneered branded residences in Dubai, partnering with Versace, Fendi, Just Cavalli, and de GRISOGONO. These collaborations create unique selling propositions and premium pricing power.

Innovative Concepts: Projects like DAMAC Lagoons (Mediterranean-themed with crystal lagoons) and DAMAC Hills (Trump International Golf Club partnership) showcase creative approach to development.

International Appeal: Strong marketing presence in Europe, Asia, and the Americas attracts diverse international buyer base, supporting liquidity and demand.

Competitive Pricing: Despite luxury positioning, DAMAC often offers more attractive entry prices compared to equivalent Emaar projects, providing better value for luxury amenities.

Key Communities:

- DAMAC Hills (Golf and leisure-focused)

- DAMAC Lagoons (Mediterranean lifestyle concept)

- Business Bay (High-rise luxury towers)

- Dubai Marina (Waterfront apartments)

- DAMAC Hills 2 (Family-oriented expansion)

Target Investor: Luxury seekers wanting unique branded experiences, international investors attracted to innovative concepts, and buyers seeking premium amenities at competitive prices.

Nakheel: The Waterfront Master

Founded: 2000

Market Position: Waterfront and coastal development specialist

Signature Style: Iconic man-made islands and premium coastal living

Why Investors Choose Nakheel:

Unmatched Waterfront Expertise: Creator of Palm Jumeirah—the world's largest man-made island—and The World Islands. No developer understands waterfront living like Nakheel.

Exclusive Locations: Nakheel properties offer unique addresses that cannot be replicated. Palm Jumeirah villas command premium prices due to their singular location and lifestyle.

Government Backing: As a Dubai government entity, Nakheel offers additional security and confidence in project completion and long-term community development.

Limited Supply Premium: Waterfront properties have natural scarcity, supporting long-term appreciation. Palm Jumeirah has shown consistent 10-15% annual appreciation over the past decade.

Key Communities:

- Palm Jumeirah (Iconic luxury island living)

- The World Islands (Ultra-exclusive private islands)

- Palm Jebel Ali (New launch with massive potential)

- Jumeirah Islands (Established villa community)

- Dragon City (Affordable family options)

Target Investor: Ultra-high-net-worth individuals seeking exclusivity, investors wanting unique waterfront properties, and buyers prioritizing scarcity-driven appreciation.

Head-to-Head Comparison Matrix

| Factor | Emaar Properties | DAMAC Properties | Nakheel |

|---|---|---|---|

| Market Share (2025) | 50B AED (Leader) | 23B AED (Strong #2) | 13B AED (Specialist) |

| Delivery Track Record | Excellent (98% on-time) | Good (90% on-time) | Good (92% on-time) |

| Price Appreciation | 8-12% annually | 6-10% annually | 10-15% annually |

| Rental Yields | 5-7% | 6-8% | 4-6% |

| Entry Price Point | Premium | Mid-Premium | Ultra-Premium |

| Payment Plans | Conservative | Flexible | Standard |

| Community Amenities | Comprehensive | Luxury-focused | Exclusive |

| Resale Liquidity | Excellent | Good | Limited (exclusive) |

| International Appeal | High | Very High | Ultra-High |

Investment Strategy: Which Developer for Your Goals?

Choose Emaar If You Want:

- Security and Reliability: Proven track record with minimal risk

- Family Living: Integrated communities with schools and healthcare

- Strong Resale Value: Blue-chip properties with consistent appreciation

- Balanced Investment: Good balance of capital growth and rental yield

Best Emaar Projects for 2025:

- Dubai Hills Estate (family-focused growth)

- Emaar Beachfront (waterfront luxury)

- The Valley (affordable entry point)

Choose DAMAC If You Want:

- Luxury at Value: Premium amenities at competitive prices

- Unique Experiences: Branded residences and themed concepts

- International Exposure: Strong global marketing and buyer base

- Innovation: First-to-market concepts and partnerships

Best DAMAC Projects for 2025:

- DAMAC Lagoons (Mediterranean lifestyle)

- DAMAC Hills 2 (established community expansion)

- Harbour Views (Dubai Harbour location)

Choose Nakheel If You Want:

- Exclusivity: Unique waterfront addresses

- Maximum Appreciation: Scarcity-driven capital growth

- Ultra-Luxury Lifestyle: Private island living

- Status Investment: Prestigious addresses for portfolio

Best Nakheel Projects for 2025:

- Palm Jebel Ali (new launch opportunity)

- The World Islands (ultra-exclusive)

- Jumeirah Islands (established waterfront)

Payment Plans and Financing Comparison

Emaar Payment Plans

- Standard: 60/40 (60% during construction, 40% on handover)

- Extended: 50/50 with 2-year post-handover option

- Premium Projects: 70/30 for high-demand locations

- Down Payment: Typically 10-20%

DAMAC Payment Plans

- Flexible Options: 1%, 5%, 10% monthly during construction

- Post-Handover: Up to 5 years on select projects

- Branded Projects: Custom plans for luxury developments

- Down Payment: Often as low as 5-10%

Nakheel Payment Plans

- Conservative Structure: 50/50 or 60/40

- Premium Projects: 70/30 for exclusive developments

- Limited Flexibility: Standard payment terms

- Down Payment: 20-25% for most projects

Risk Assessment: What to Consider

Emaar Risks (Minimal)

- Premium Pricing: Higher entry costs

- Market Saturation: Large supply in some communities

- Conservative Growth: Steady but not explosive returns

DAMAC Risks (Low-Medium)

- Concept Execution: New themes may not resonate with all buyers

- Market Volatility: Luxury segment more sensitive to economic cycles

- Competition: Multiple developers targeting luxury segment

Nakheel Risks (Medium)

- Limited Supply: Fewer project options

- Ultra-Premium Pricing: High entry barriers

- Liquidity Concerns: Smaller resale market for exclusive properties

Market Trends Favoring Each Developer

Trends Supporting Emaar (2025-2027)

- Family Migration: Increasing expat families choosing Dubai

- Stability Demand: Post-pandemic preference for reliable developers

- Master Community Living: Growing demand for integrated communities

Trends Supporting DAMAC (2025-2027)

- Experience Economy: Buyers wanting unique lifestyle concepts

- International Investment: Strong global property investment flows

- Luxury Affordability: Premium amenities at accessible prices

Trends Supporting Nakheel (2025-2027)

- Ultra-Luxury Demand: Growing UHNW population in Dubai

- Scarcity Premium: Limited waterfront land driving values

- Exclusive Living: Post-pandemic privacy and exclusivity trends

Expert Recommendations by Investment Profile

Conservative Investors (Low Risk, Steady Returns)

Recommendation: Emaar Properties

Why: Proven track record, strong resale values, comprehensive communities

Best Pick: Dubai Hills Estate apartments or The Valley townhouses

Growth Investors (Medium Risk, High Potential)

Recommendation: DAMAC Properties

Why: Innovative concepts, international appeal, competitive pricing

Best Pick: DAMAC Lagoons villas or Harbour Views apartments

Premium Investors (Higher Risk, Exclusive Returns)

Recommendation: Nakheel

Why: Unique locations, scarcity-driven appreciation, ultra-luxury positioning

Best Pick: Palm Jebel Ali villas or The World Islands plots

Portfolio Investors (Diversified Approach)

Recommendation: Mix of all three

Strategy: 50% Emaar (stability), 30% DAMAC (growth), 20% Nakheel (premium)

Due Diligence Checklist for Any Developer

Before committing to any project, regardless of developer reputation:

Financial Verification:

- Verify RERA registration and project approvals

- Confirm Escrow account setup and bank details

- Review developer's recent financial statements

- Check construction progress for similar projects

Legal Protection:

- Engage qualified legal counsel for SPA review

- Understand payment schedule and milestone triggers

- Verify completion date commitments and penalties

- Review handover procedures and warranty terms

Market Analysis:

- Research comparable property prices in the area

- Analyze rental market demand and yields

- Assess future infrastructure development plans

- Evaluate resale market liquidity and trends

Conclusion: Making Your Decision

The choice between Emaar, DAMAC, and Nakheel ultimately depends on your investment goals, risk tolerance, and lifestyle preferences:

- For Security and Family Living: Emaar's integrated communities offer the best balance of reliability and lifestyle

- For Innovation and Value: DAMAC provides luxury experiences with competitive pricing and unique concepts

- For Exclusivity and Prestige: Nakheel delivers unmatched waterfront living with scarcity-driven appreciation

Remember, all three developers have strong track records and government backing. The "best" choice is the one that aligns with your specific investment strategy and personal preferences.

Ready to explore properties from Dubai's top developers? Our team has exclusive access to the latest launches and pre-launch opportunities from Emaar, DAMAC, and Nakheel. Contact us for a personalized consultation and discover which developer and project combination best suits your investment goals.

These are among the most reputable names behind top offplan properties.